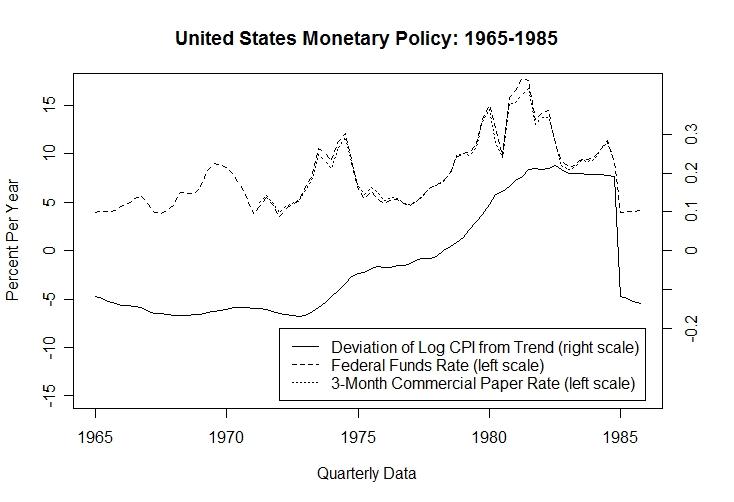

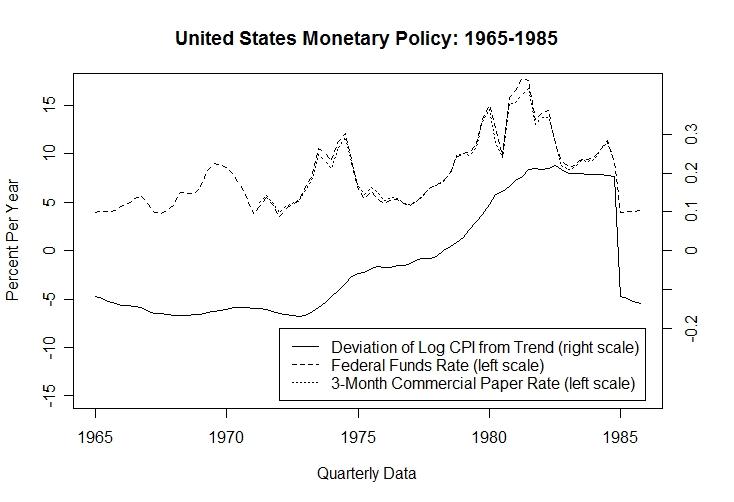

It is clear from the figure that when the inflation rate (slope of the deviation of log CPI from trend) was high the Federal Reserve system tightened monetary policy by raising domestic interest rates. The inflation therefore occurred despite the tight monetary policy.

True or False?

The above argument is clearly false. While it is true that interest rates increased sharply during the periods 1972-1975 and 1978-1982 when the inflation rate (slope of the deviation of log CPI from trend line) was high, this would have occurred independently of Federal Reserve action because the interest rates observed are nominal interest rates which increase with increases in the public's inflationary expectations. It is real interest rates that the monetary authorities have to increase to invoke tight money, and there is no evidence that they increased much before the inflation rate began to decline in 1980. This illustrates the problem with using interest rates as a measure of the tightness of monetary policy. Only nominal interest rates are observable, and these are poor indicators of the level of real interest rates because they incorporate the level of inflationary expectations which is difficult to estimate.