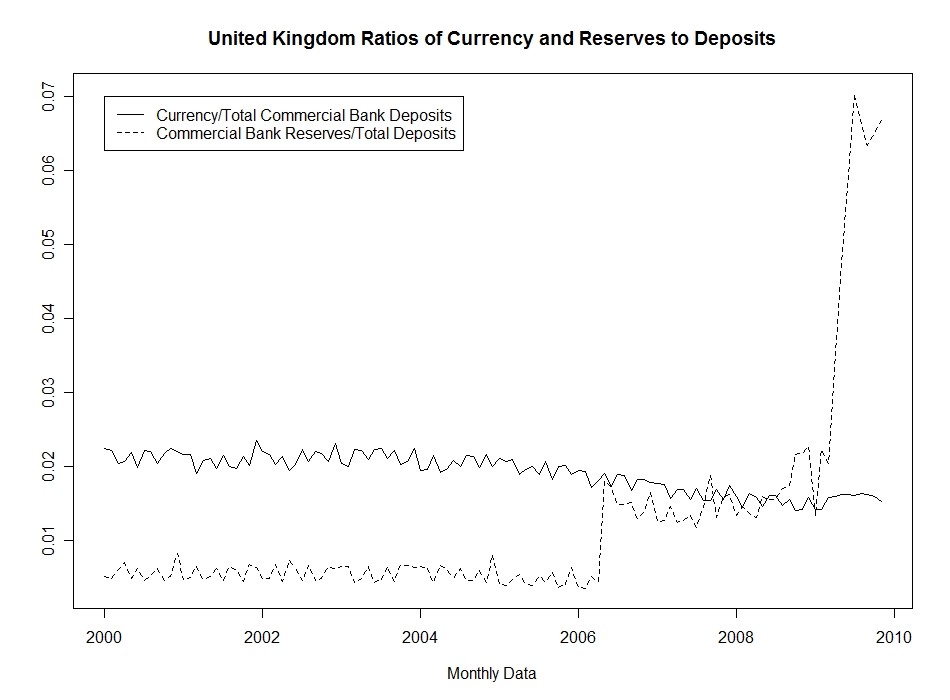

As the first figure below shows, the British currency/deposit ratio was not much affected by the financial crisis, while the reserve/deposit ratio increased by about 450 percent which, though greater than the corresponding Canadian increase was still substantially below the 1500 percent increase in the United States.

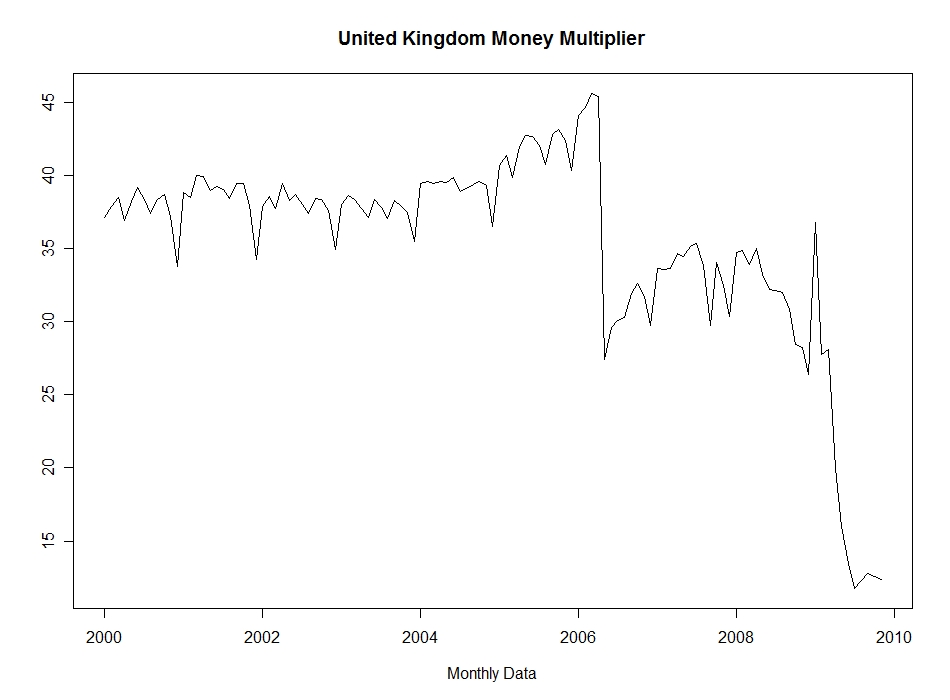

As can be seen below, this resulted in a decline in the money multiplier in the United Kindom to less than 1/3 of its 2007 level.

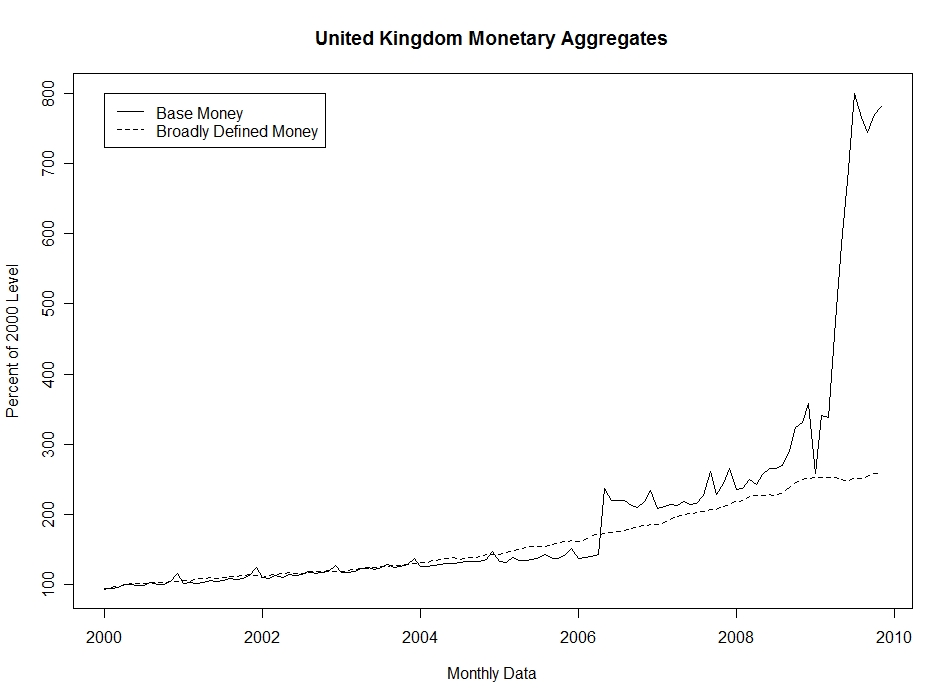

As in the United States, the Bank of England expanded the stock of base money sufficient to eliminate all of the effect of this money multiplier change in the broadly defined monetary aggregate.

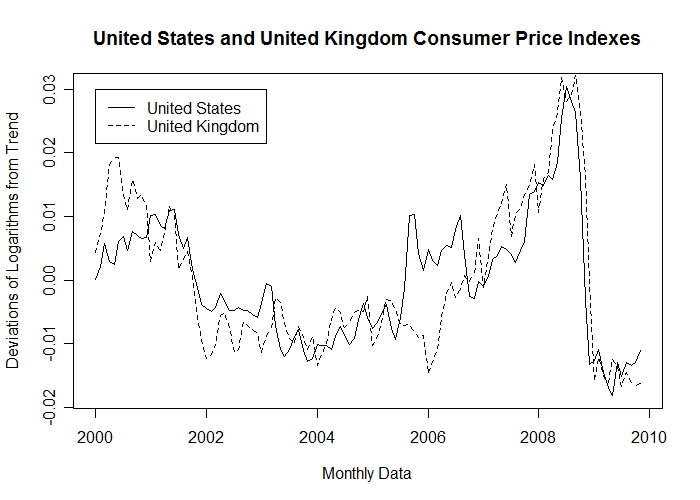

Nevertheless, as is clear from the final figure below, the effect of the contraction on the price level in the United Kingdom was roughly the same as that on the United States price level.