We now extend the analysis of real and nominal exchange

rate determination under long-run conditions when the economy is

operating at full or near-full employment. The focus of analysis

will be Equation 10 of the previous topic. That equation arises from

the equilibrium condition that savings minus investment (or the net

capital outflow) must equal the current account balance (balance of

trade plus the debt service balance), where all of these variables

are desired magnitudes and all are measured in real terms.

where ΦS-I represents factors affecting the excess of savings over investment other than income and the world real interest rate, ΦBT represents the factors affecting the balance of trade other than incomes and relative prices and s , the marginal propensity to save, equals (1 − ξ) when there is continuous full employment. Since Y* and r* are determined by conditions in the in the rest of the world, DSB is determined by previous international borrowing and lending, and ΦS-I and ΦBT are constants, the only variables that can adjust to preserve the equality are the level of domestic income Y and the real exchange rate Q . Under continuous full-employment conditions Y = YF so only the real exchange rate can adjust to preserve equilibrium. The real exchange rate is defined as

where P and P* are the domestic and foreign price levels and Π is the nominal exchange rate defined as the domestic currency price of foreign currency. Under flexible exchange rates, Π will adjust to maintain Q at its equilibrium level while, under fixed exchange rates with continuous full employment and given conditions abroad, the domestic price level P will rise and fall with changes in Q .

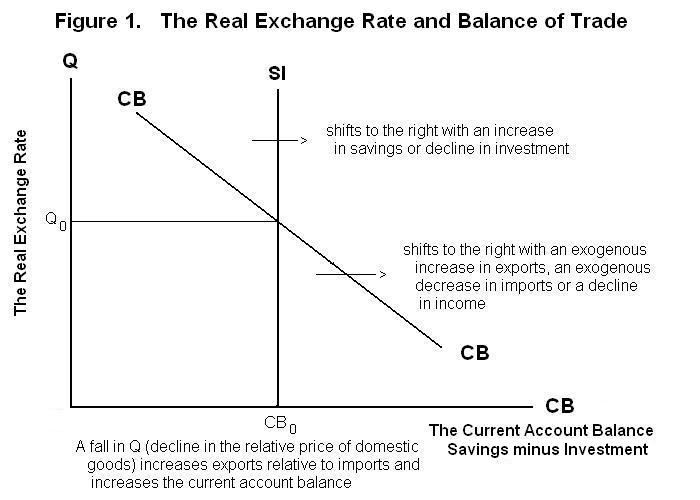

This adjustment process can now be analyzed with reference to Figure 1.

The horizontal axis measures the excess of savings over investment (or net capital outflow) and current account balance and the vertical axis measures the real exchange rate. The vertical SI line represents the excess of real savings over real investment as indicated by the left side of the above equation of equilibrium---the line is vertical because changes in the real exchange rate under full-employment conditions do not affect either savings or investment. An exogenous positive shift of savings or negative shift of investment, represented by an increase in ΦS-I will shift the SI line to the right. A rise in YF will increase domestic savings and an increase in the world interest rate will reduce domestic investment, also shifting SI to the right. The negatively sloped CB line represents the current account balance, given by the right side of the equation of equilibrium. An increase in domestic income shifts CB to the left while a rise in foreign income or a shift in ΦBT shifts CB to the right. A rise in the real exchange rate makes domestic goods more expensive relative to foreign goods, leading to a reduction in the current account balance---this accounts for the negative slope of CB.

Equilibrium is brought about by a change in Q that moves the current account balance in the opposite direction along the CB curve until it equals the net capital outflow. Equilibrium will occur at the real exchange rate and current account balance at which the CB curve crosses the vertical SI line.

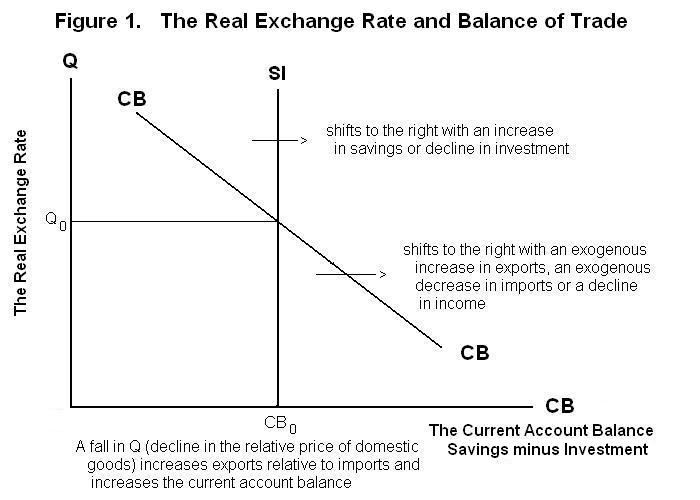

Suppose that the domestic economy becomes a better place to invest than it had been previously. This will shift the vertical SI line to the left in Figure 2.

The new equilibrium will occur at a higher real exchange rate and a smaller positive or bigger negative current account balance. The shift of investment into the domestic economy increases the aggregate demand for domestic output. The real price of that output, represented by the real exchange rate, must rise for equilibrium to be maintained. This rise in the real price can occur as a result of an increase in the domestic price level or an increase in the nominal value of the domestic currency in the international market (fall in Π ). The mix of nominal exchange rate and price level adjustments that actually occurs will depend on the government's monetary policy and other factors to be considered in subsequent lessons.

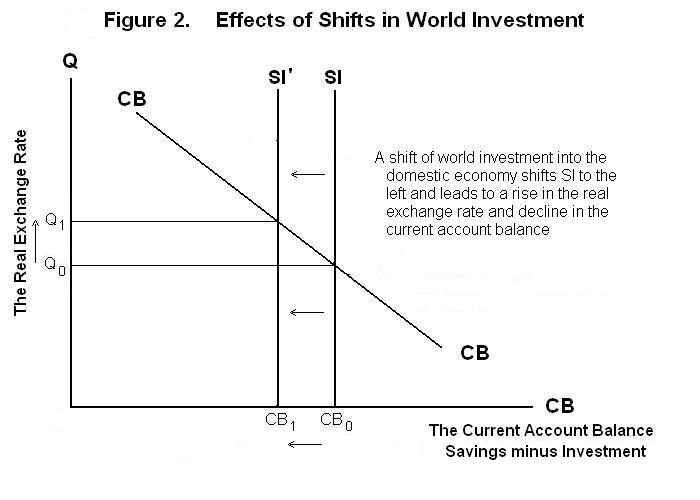

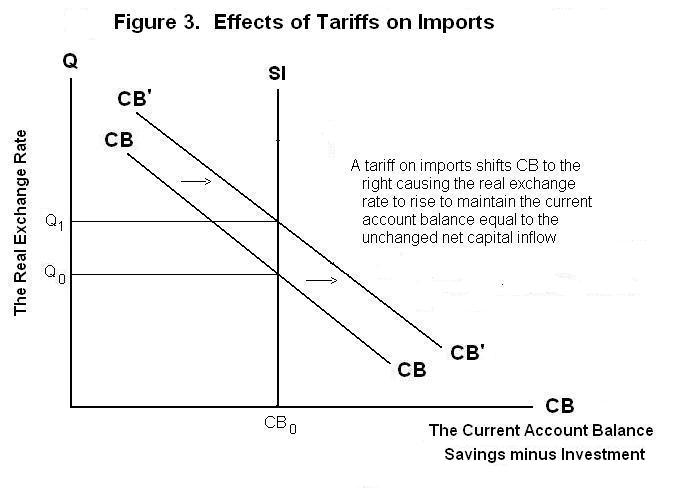

Suppose alternatively that the domestic government imposes a tariff which shifts domestic expenditure from imports to domestic goods. The effects of this are analyzed in Figure 3.

The CB curve shifts to the right. Again, the aggregate demand for domestic output increases and the relative price of domestic output in the world market must rise. The tariff increases the real exchange rate sufficiently to return the current account balance to its previous level. No change in the current account balance can ultimately occur because nothing has happened to change the net capital outflow. The equilibrium balance on current account can change only if there is also a change in the equilibrium net capital flow.

This example draws attention to a nonsense argument that frequently appears in the popular press. It is often argued that, say, Canada's current account balance got larger because of an increase in the demands of foreigners for Canadian goods. In fact, an increase in the current account balance can only occur if there is an increase in the equilibrium capital account balance as represented by an increase in savings or decline in investment. Without changes in savings or investment, a change in foreign demand for domestic goods will simply result in a change in the country's real exchange rate, with the current account balance remaining unchanged. Any argument about what caused the current account balance to change must address the factors determining the net capital flow.

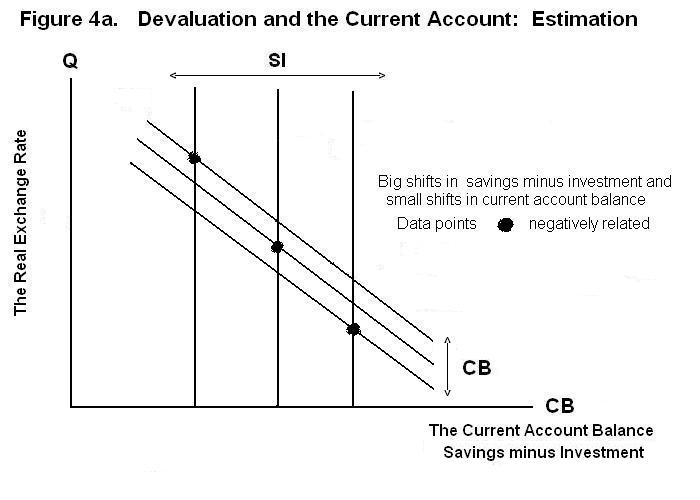

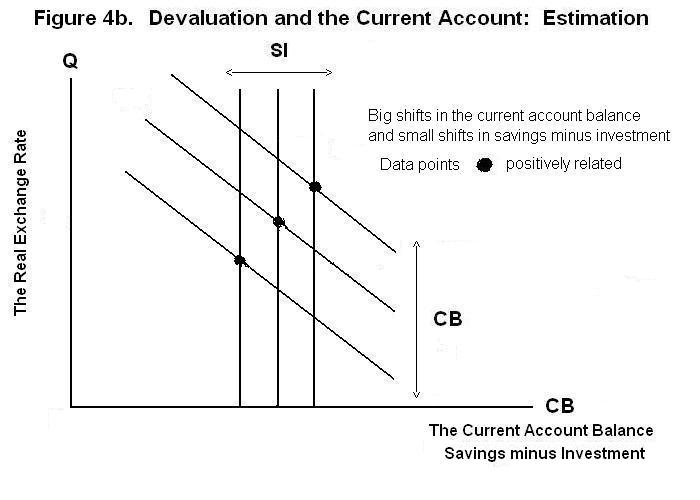

It is often thought that the effects of real exchange rate changes on the current account balance can be seen in the published data, with observed increases in the current account attributed to observed declines in the real exchange rate. That this argument is inappropriate should be clear from Figures 4a and 4b.

If there have been many shifts in the factors determining savings and investment but few shifts in the factors (other than the real exchange rate) determining exports and imports, the observed combinations the real exchange rate and current account balance will trace out a relationship with a negative slope like the CB curve as shown in Figure 4a but this slope will be different than that of the CB curve. If, on the other hand, there have been a lot of shifts in exports and imports unrelated to the real exchange rate the observed relationship between the real exchange rate and current account balances can be positively sloped, as in Figure 4b, even though CB has a negative slope. This difference between the slope of a line relating the observed combinations of the real exchange rate and the current account balance and that of the CB curve is called a simultaneity bias.

The basic equation of equilibrium can be manipulated to yield an expression determining the real exchange rate by bringing Q to the left side.

This relationship is not very instructive in analyzing long-run movements in the real exchange rate, however, because changes in full employment incomes and in world interest rates are frequently associated with changes in technology that also affect the terms ΦS-I and ΦBT . Without specific knowledge of the forces causing these terms to shift we can't say much. Econometric estimation of the slope of the CB curve involves the use of instrumental variable techniques to deal with the simultaneity. Understanding of these techniques requires a sound grounding in the field of econometrics.

The relative price of domestic output in the world market Q will, according to typical supply and demand analysis, be determined by world demand for domestic relative to foreign goods and by technology and other factors that may shift the supply of domestically produced goods relative to the supply of goods produced abroad.

Finally, it should be noted that nothing in the above discussion says anything about balance of payments equilibrium, which depends not on the total net capital flow or current account balance, but on the portion of the net capital flow that represents induced transactions which, it will be recalled, are those motivated by the government's desire to manipulate the nominal exchange rate. In developed economies these mainly involve changes in official reserves of foreign exchange. The analysis of balance of payments equilibrium involves money and monetary policy issues that will be brought into consideration in subsequent lessons.

It is test time again. Be sure to think up your own answers before looking at the ones provided.

Question 1

Question 2

Question 3

Choose Another Topic in the Lesson