A large group of firms and financial institutions produce

financial advice and brokerage and portfolio management services

for wealth owners. This is, of course, an efficient use of

resources because it frees wealth-owners, at least to some

degree, from asset-management tasks and allows them to specialize

in their own areas of expertise. Individuals from time to

time also claim expertise on the basis of their past investment

success and attempt to sell advice or portfolio management

services to others.

Fundamental difficulties arise, however, in determining

whether people and institutions who achieve investment success

are truly successful investors or just lucky.

Consider the following simple illustration. Suppose that

the economy will be affected as time passes by four important

developments (such as the invention of computers, the globalization

of markets, the decline of agriculture, or whatever) and

that absolutely nobody in the economy can predict what these

developments are or what their effects on asset values will be.

Suppose further that as a result of each of these developments,

there is a 50 percent chance that the value of one's stock-market

investments will increase by half its current value and a 50 percent

chance that it will decrease by one-third its current value.

The concepts developed in this lesson yield important

insights into how one should manage one's asset portfolio. A

discussion of these constitutes an excellent review of what you

should have learned.

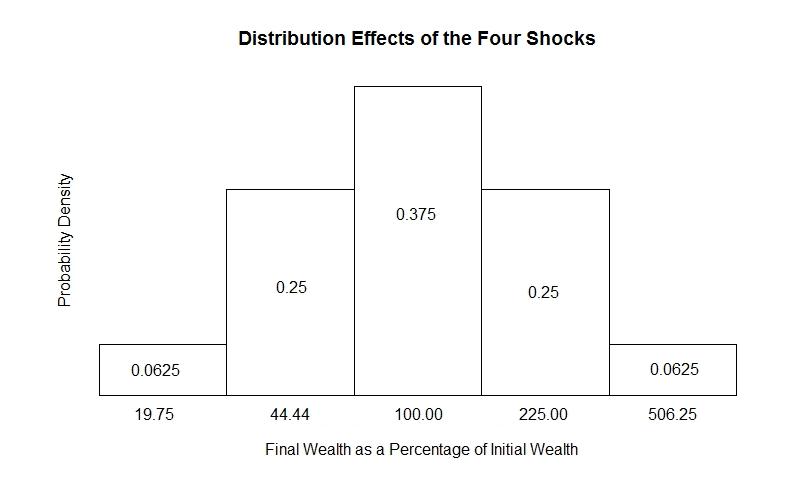

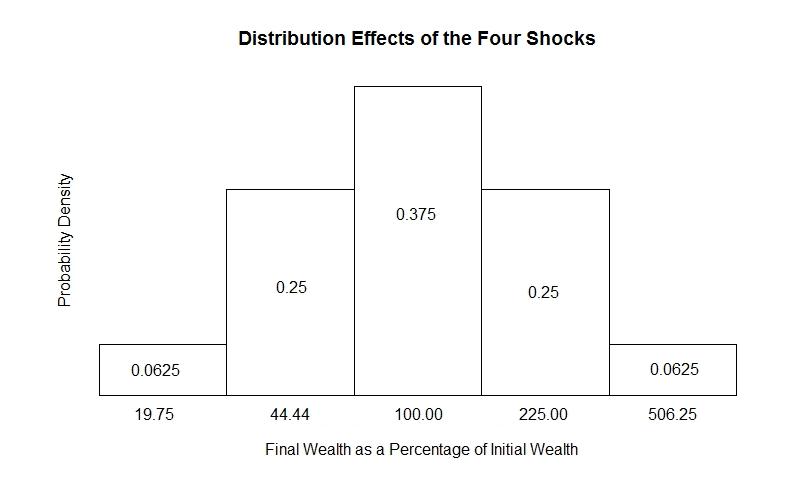

The Figure above presents a bar chart of the values of individuals' portfolios after the four shocks as a percentages of the values before the four shocks. It turns out that 6.25 percent of the people end up with portfolios that are a bit more than 5 times more valuable and an equal percentage will find that find that their portfolios have declined in value to a bit under 20 percent of their original values. One quarter of the people end up their portfolios being 2.25 times more valuable and another quarter wind up with portfolios only 44 percent as valuable as originally. And about 37.5 percent of investors will find the value of their portfolios unchanged.

In a world where there is a lot of "apparent"information floating around and people do not realize that they indeed know nothing about how to interpret it, one would not be surprised to find a number of the big winners offering investment advice for a price. Or perhaps they might market a book on how they made themselves wealthy.

One who observes the distribution in the above Figure and does not know what the individual investors knew or did not know about developments in the economy could make a quite different interpretation. It could have been the case that a lot of information was available and that 6.25 percent of the people were very perceptive in evaluating it. Another 6.25 percent are stupid, 37.5 percent managed to get it right half the time, and the remainder of the population divides equally between those that did a bit better than average and those that did a bit worse. This alternative view is fully consistent with the evidence.

The important difference between these two interpretations of the evidence observed in the Figure lies in the implications for one's future behavior. If the random chance interpretation is correct, one should simply let chance take its course and devote one's energies to other pursuits. If the smart-investor interpretation is correct, one should try to learn from the past experiences of those who have been successful and perhaps hire them to manage one's investments.

The lesson we learn from this example is that it is impossible to know whether a successful investor is smart or just lucky. Longer and longer strings of success do not provide clear evidence of investment smarts because no matter how long the period there is a positive probability that some individuals in a large population of investors will be astoundingly successful.

You will learn more about how to manage your investments as you work through the three test questions to which we now turn. It is very important that you think up your own answers before looking at the ones provided.

Question 1

Question 2

Question 3

Choose Another Topic in the Lesson