Consider again a situation where the insitution responsible for managing

the money supply increases it substantially. People will find themselves

holding too much money in relation to their holdings of other assets

including real physical capital. Their response will be to purchase capital

assets with their excess money holdings. The result will be a rise in the

prices of those assets, given the current on-going income streams from them.

The resulting increase in the value of new capital relative to the cost of

producing it will stimulate investment, leading to an increase in the production

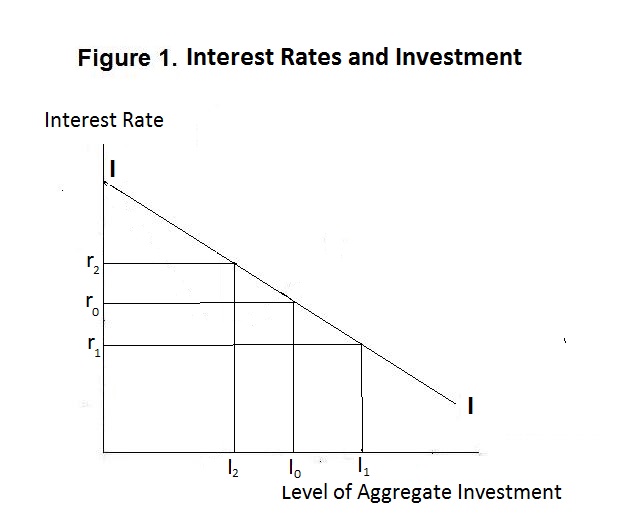

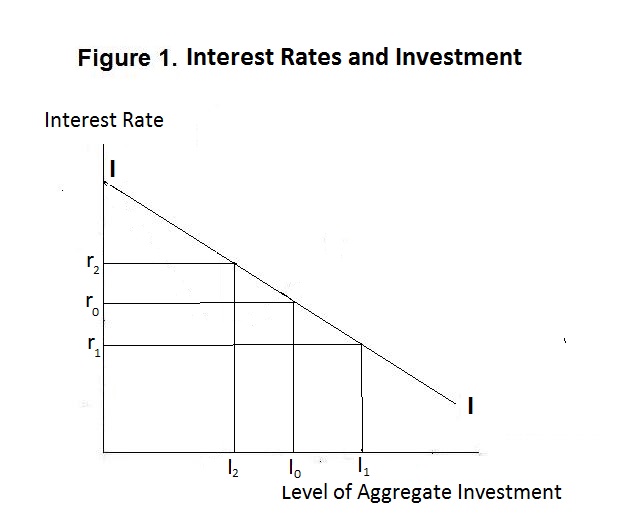

of new capital and a corresponding increase in output. This relationship

beteen the interest rate and level of investment is portrayed in Figure 1

below.

We must now take account of the the fact that an increase (decrease)

in the supply of money will lead initially to an increase (decrease) in the

level of employment and only eventually to a proportional increase (decrease)

in the level of prices. Workers and firms will only change prices after

pressure on the demand for their services, indicated by corresponding

changes in employment and output, has been observed. And prices will

change only in association with changes of wages in the same direction.

The response of investment to interest rates, denoted as the Investment Function, is given by the curve (actually, line) II. A monetary expansion, leading to an increase in the demand for real assets, raises asset prices and lowers the interest rate that will be earned, given the flow of asset returns. This fall in the interest rate from r{0) to r{1) and the corrsponding rise in asset prices relative to the cost of producing the associated capital goods leads to an expansion of aggregate investment from I{0) to I{1}.

Note that the relevant interst rate in the above argument is the real interest rate rather than the nominal one.

Suppose the alternative occurs, with the quantity of money declining or the demand for money increasing. The resulting attempt to acquire money by selling assets will lower asset prices and raise the interest rate on real capital from r{0) to r{2). The fall in asset prices relative to the cost of producing the capital goods will lead to a reduction of investment from I{0) to I{2} in the figure above.

In the case where output and employment increase, workers and firms will eventually recognize, as will be shown below in Macroeconomics Lesson 4, that the full-employment equilibrium nominal wage rate has increased and will respond by increasing wages and then prices. The price level will eventually rise in proportion to the increase in the money supply with the real money stock returning to its original level. This reduction in real money holdings will induce an attempt by asset holders to sell capital for money balances to maintain asset equilibrium with the result that capital asset prices will fall relative to the cost of producing capital goods and the real interest rate will increase back to r{0), with investment, measured in real terms, returning to its long-run equilibrium level I{0). The opposite will occur in the case where the level of employment has declined. Once workers realize that the demand for real labour services has fallen, wages will fall, with firms reducing prices as well. This will increase real money holdings and lead to an attempt by asset holders to rebalance their asset portfolios by exchanging money for real assets. Asset prices will rise and the real interest rate will fall back to r{0), with real investment returning to I{0). The fall in the price level will be proportional to the initial fall in nominal money holdings with the real money stock going back to its equilibrium level, given the aggregate real capital stock.

It is now time for a test. Be sure to think up your own answer before looking at the one provided.

Choose Another Topic in the Lesson