We start with the fiscal budget constraint that every government faces.

1.

G = T +

ΔB/Δt + ΔM/Δt

where G is government expenditure, T is taxes,

t is time and

ΔB/Δt and ΔM/Δt are the

current-period changes stocks of government bonds and money held by the

public. This constraint says that the government must finance its expenditures

by either levying taxes, selling bonds to the public (increasing the stock

of bonds at the rate ΔB/Δt) or printing money

(increasing the money stock at the rate ΔM/Δt).

The government budget deficit, government expenditures minus taxes, must be

financed by either borrowing (selling bonds) or printing money.

Suppose that the government runs a deficit and finances it

by printing money. For the sake of argument, we assume that the

deficit is $1 billion and that the money supply is initially $10

billion. The government prints $1 billion of new money, giving it

to the public in return for $1 billion worth of real goods and

services. The public sells these goods and services to the government at

market prices and receives an equivalent amount of money

return---the goods and services are part of G, which

exceeds T by 1 billion dollars.

But the nominal money supply is now ten percent ($1 billion/

$10 billion) higher and, given the public's unchanged desired

holdings of real money balances, the price level will eventually

rise by 10 percent. As a result, the public ends up with 10

percent larger nominal money holdings, which it gave up real goods

and services to obtain, but faces a 10 percent higher price level.

Since its real money holdings have not changed, it has received

nothing for the goods and services it gave to the government. The public

is no better off than it would have been if the

government increased taxes by $1 billion dollars and used those

funds to purchase the goods and services from it.

By printing money instead of raising income or sales taxes,

the government is taxing money holdings instead of income or

sales. Since the price level rises by 10 percent, everyone loses

10 percent of their initial money holdings and has to give up an

equivalent amount of their current income to acquire sufficient

additional nominal money holdings to maintain their real money

holdings at the desired level. Had income taxes been increased

instead, the government would have taken $1 billion (the same

amount) directly off their current year's earnings.

Of course, even non-inflationary growth of the money supply

that satisfies the public's desire to hold additional real money

balances as real income grows provides revenue to the government,

which simply prints the money and uses it to purchase goods and

services. This revenue from money creation is called seigniorage.

An important feature of the inflation tax is that people are

taxed in proportion to the amount of money they hold. A person

who holds $100,000 cash in the bank will be taxed by $10,000, to

use the above example, where as a person who holds only $100 cash

in the bank will be taxed just $10 dollars. Confronted with the

greater inflation rate, both these individuals are going to try

to get by with smaller money holdings. They will hold less money

for the same reason that they would try to use less gasoline if

the government had taxed it. This tendency to hold less real money

holdings when the rate of inflation rises results from the fact that

the cost of holding money is equal to the nominal interest rate,

which contains an allowance for inflation. Consider again the

Fisher equation

2.

i = r +

τ

where i is the nominal interest rate, r is the real

interest rate and τ is the expected rate of inflation. As

τ rises, so does i for any given r .

We saw in the previous Topic that people hold less money when the cost of

holding it increases.

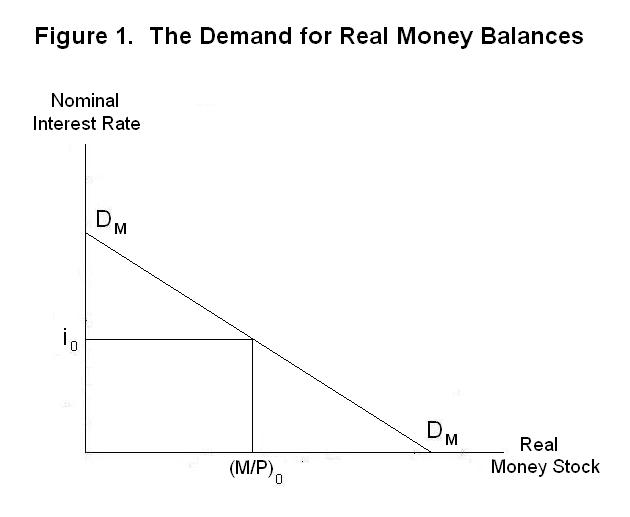

This prompts us to model the demand for money in a different

but, of course, equivalent way than we did in the previous Topic.

We can put the real money stock on the horizontal axis instead of

the nominal money stock, and the cost of holding money on the

vertical axis, as shown in Figure 1. The demand curve for money

on this graph, called DMDM, is downward

sloping because people hold more money when the cost of holding it falls.

A measure of the benefit from holding an additional unit of money is given

by the vertical distance between the demand curve and the horizontal axis at

the quantity of real money balances initially held.

Our next task is to show that inflation is, in fact, a tax on

money holdings. Then, after exploring some implications of this

fact, we will examine again the reason why some countries have high

inflation rates.

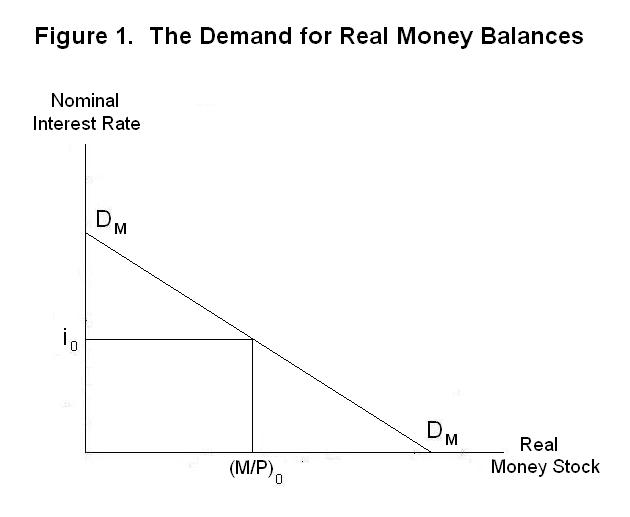

Let us compare this demand curve for real money balances with the demand curve for nominal money balances developed in the previous Topic, shown here in Figure 2. The price on the vertical axis in Figure 1 is the price of a unit of real money holdings in terms of the interest sacrificed by not investing in real capital or bonds, whereas price on the vertical axis in Figure 2 is the amount of real output that has to be given up to get one unit of nominal money.

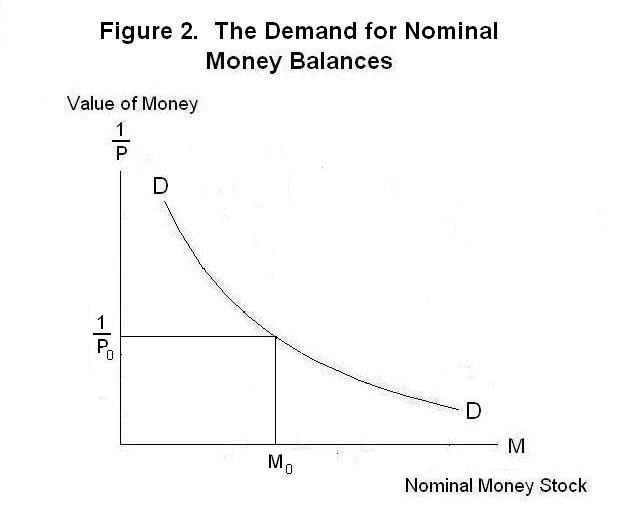

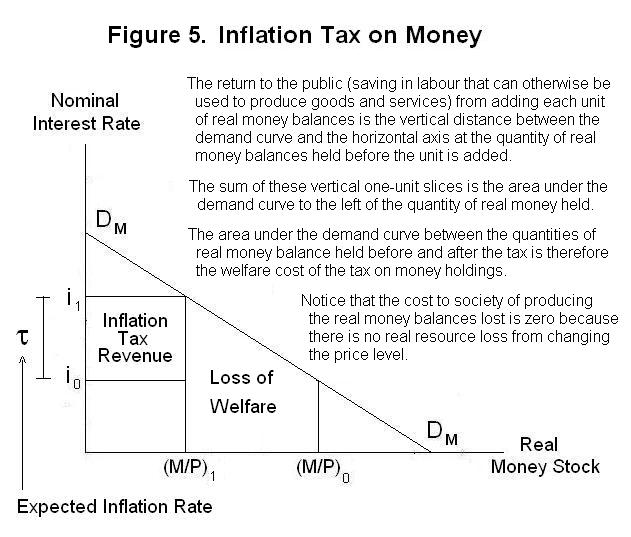

Suppose that, starting with a zero rate of actual and expected inflation, the government begins increasing the money supply at a 10 percent faster rate than previously. The expected inflation rate will soon rise to 10 percent. At that point, the nominal interest rate will have risen 10 percentage points above the real interest rate to i1 in Figure 3. Previously, when there was no inflation, it equaled the real interest rate r0. The public reduces its real money holdings from (M/P)0 to (M/P)1. Given the nominal money stock in circulation at any point in time, there will have to be a one-shot rise in the price level to bring about the appropriately lower real money stock. The inflation tax on real money holdings is the designated rectangle in Figure 3.

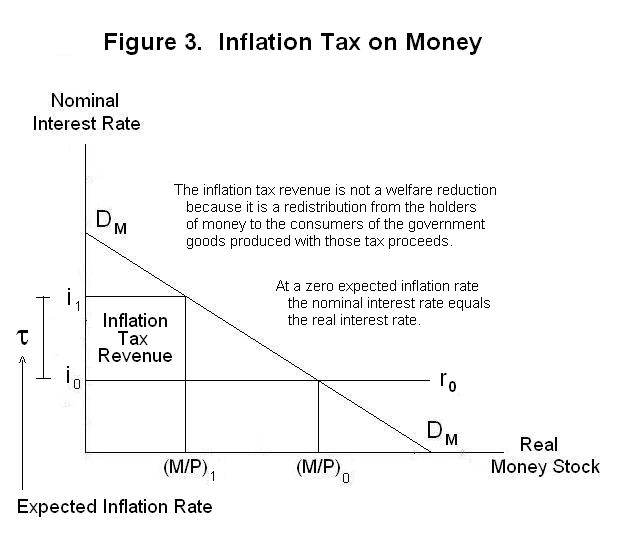

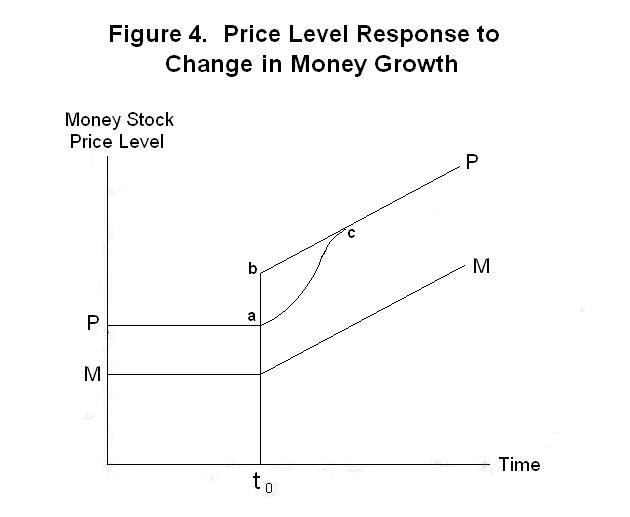

We can now see that the decision of the government to finance a deficit by printing money will have two effects on the price level. First, by increasing the rate of inflation it will increase the rate at which the price level is increasing. Second, once the public realizes that the inflation rate has increased there will be a once-and-for all jump in the price level to reduce real money holdings to the new lower desired level. These two effects are shown in Figure 4.

Nominal money holdings and the price level are on the vertical axis and time is on the horizontal one. The line MM shows the time path of the nominal money stock and the line PP represents alternative time paths of the price level. If the public realizes immediately that the government has decided to finance its budget deficit by printing money, the price level will jump up immediately from point a to point b and continue to increase by a constant amount per period thereafter. If it takes people some time to realize what is happening, the jump will be spread over an interval of time as shown by the line running from point a to point c .

As can be seen from the government's budget constraint presented in Equation 1, it can run a budget deficit without printing money by simply borrowing from the public the money it spends in excess of its tax revenues. This would seem to be a preferable way of financing the deficit because it does not increase the rate of inflation.

Inflation, even when it is fully expected, is bad for several reasons. First, it causes people to hold less money and thereby use up time and effort running back and forth to the bank and transferring funds between interest earning assets and chequing accounts. This cost is shown by the area under the demand curve for real money holdings between (M / P)1 and (M / P)0 in Figure 5. As each unit of real money balances is added the benefit from adding that unit is the amount people are willing to pay to have it, which is the vertical distance between the demand curve and the horizontal axis multiplied by one. The additional money costs nothing both because fiat money can be created by the government at virtually zero real resource cost and it costs nothing to have one initial equilibrium price level rather than another. Accordingly, the social gain from holding any particular quantity of real money balances is the area under the demand curve for real money balances to the left of the quantity held. At a minimum, therefore, the welfare cost of the inflation tax is the area under the demand curve between the pre-tax and post-tax equilibrium quantities of real money balances. By having a lower inflation rate the government can induce the public to hold more money and save the shoeleather costs of running back and forth to the bank and the busywork costs involved in transferring funds into and out of chequing accounts.

An additional cost of inflation is that firms and workers have to be constantly raising prices, printing new catalogues and changing signs. These are called menu costs. And a further cost is the resources that the government has to use up constantly adjusting nominal tax rates, pensions, welfare benefits, and so forth, to keep the real impact of its actions on the economy the same. These adjustments do not come without political wrangling and other costs. More costs arise when inflation is unexpected and highly variable---it is almost always the case that countries with high inflation also have large variations in their inflation rates. The result is continual wealth redistributions back and forth between debtors and creditors.

If inflation is so bad, and we know how to avoid it, why do some countries have it? It turns out that the underlying cause of high inflation is political. A country, faced with high inflation can do one of three things. First, it can borrow from the public instead of printing money. To do this, governments of countries with high inflation have to pay very high interest rates---they must compensate borrowers for the expected loss in real value of the public debt due to the prospect of future inflation. Unless it can convince the public that it is going to control inflation, the government will face prohibitive borrowing costs. A second thing the government can do is raise taxes to eliminate the deficit. To do this it must have the political support to be able to force people to pay the more taxes. Since every segment of the community wants some other segment to pay the taxes, the government may not be able to raise taxes and keep itself in power. Finally, of course, the government can eliminate its budget deficit by reducing government expenditures. This usually means that it will have to employ less people and provide less services. Government employees may have the political power to prevent widespread layoffs in the public sector, particularly if it is a large fraction of the economy, and powerful special interest groups may be able to prevent the elimination of government subsidies. Again the government's ability to retain power will be at risk. It is not an accident that countries experiencing very high inflation rates suffer from political instability. It is because of that instability that their governments cannot maintain proper control over their money supplies.

It is now time for a test on this Topic. Again, think up your own answers before looking at the ones provided.

Question 1

Question 2

Question 3

Choose Another Topic in the Lesson