A situation where the price level is rising is called

inflation. This term is commonly used in two ways: first it

can refer to a rise in the price level that has occurred or will

occur over a period of years; second, it can refer to on-going

year over year increases in the price level. In this latter

case, the growth of the price level is called the inflation

rate.

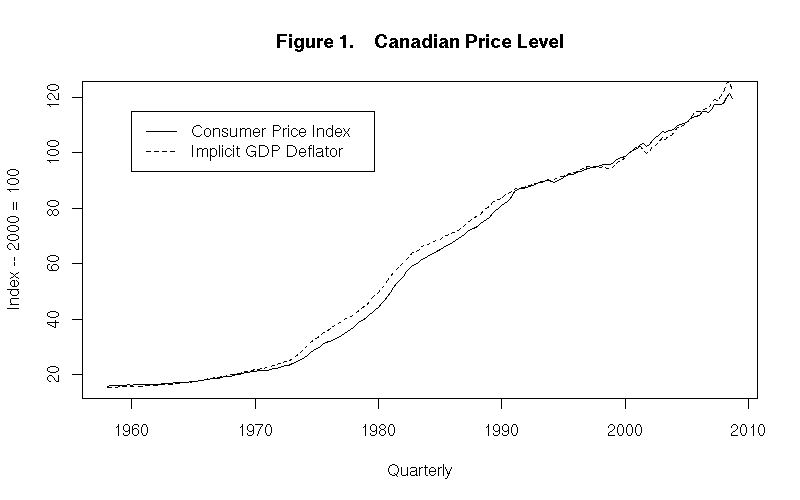

Figure 1, already introduced in the previous topic, shows the time paths of two measures of the Canadian price level---the CPI and the implicit GDP deflator. As was noted, both these measures indicate that the price level rose almost eight-fold between 1958 and 2008. Canada has clearly experienced substantial inflation over the period.

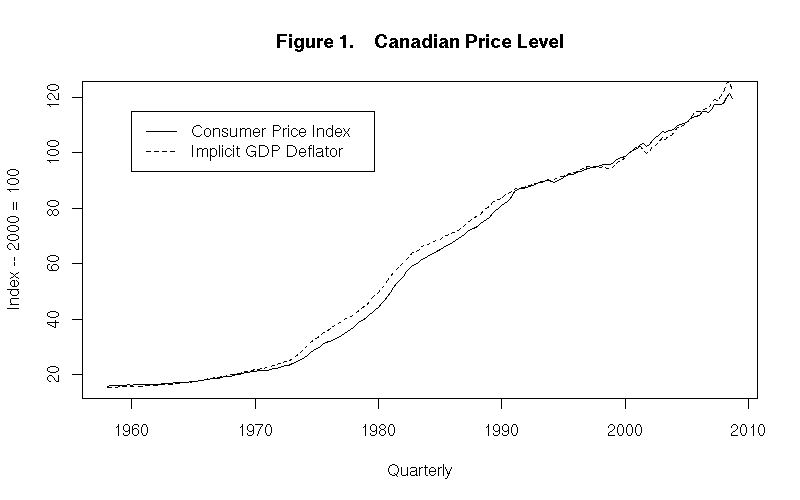

The inflation rate can be measured by calculating the percentage rate of growth of the price level from year to year. This equals the percentage change of the current level of the price index over its level one year ago.

The percentage rates of growth of the Canadian CPI and the implicit GNP deflator are plotted in Figure 2. The data are quarterly so the inflation rate for each quarter is the percentage increase of the price level from the same quarter of the previous year. While the movements of these series are broadly similar, there is enough difference between them to suggest that the inflation rate cannot be measured with great precision.

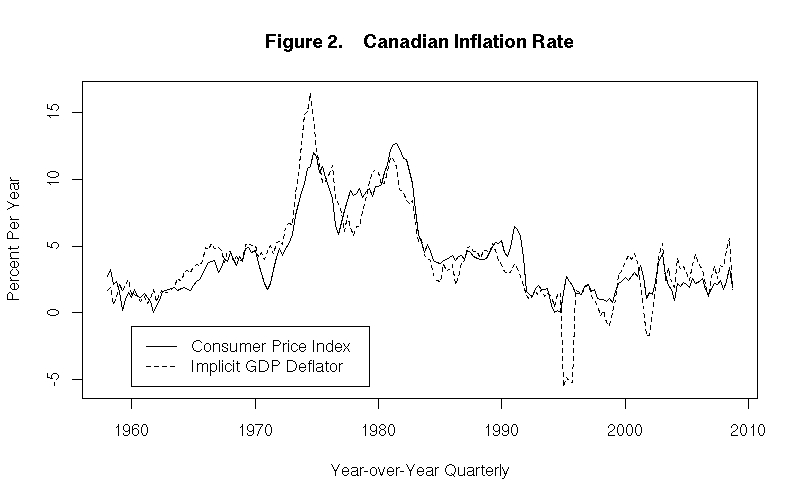

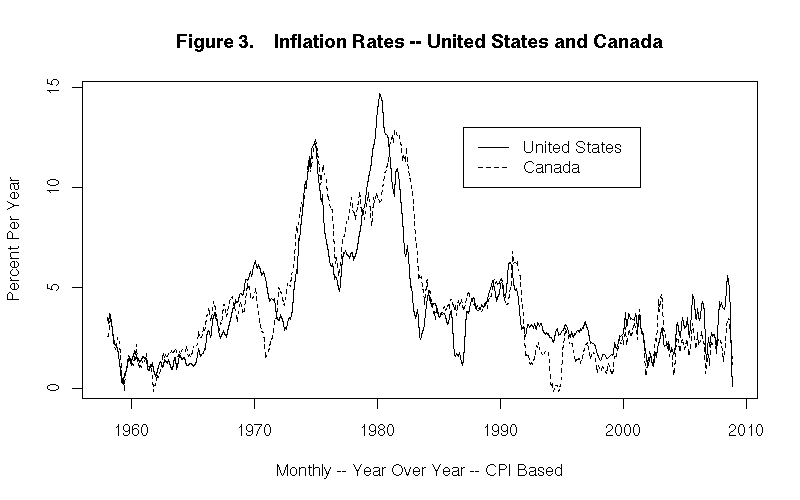

Figure 3 presents the inflation rates of Canada and the United States (using the CPI measure) for the period 1958 through 2008. These data are monthly and measure the inflation rate for each month as the percentage increase from the same month of the previous year. Note the remarkable similarity of the inflation rates of the two countries although they differ by as much as 2 percentage points on a few occasions for very short periods.

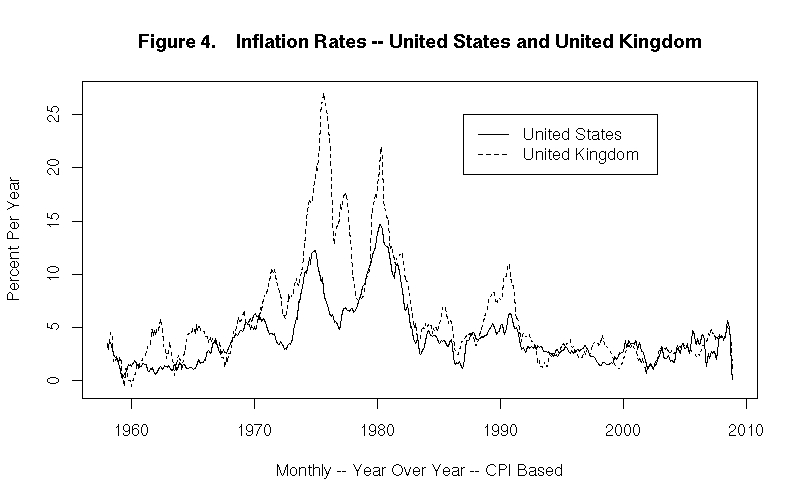

Figure 4 shows the inflation rate of the United Kingdom as compared to the United States. While British inflation rate tended to be higher that of the United States prior to 2000, it shows similar peaks in the mid-1970s and around 1980 and 1990. And, like the U.S. inflation rate, the British inflation increased, on average, between 1960 and 1980 and then declined, on average, until the late 1990s.

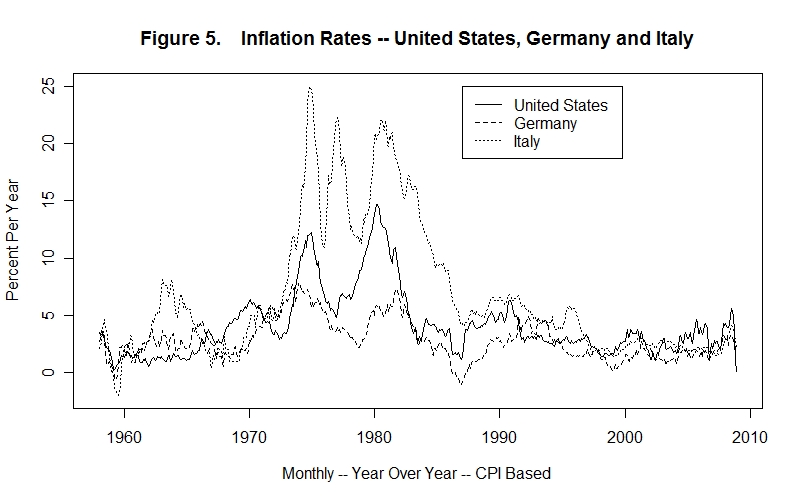

This similarity in the patterns, though not the levels, of inflation rates extends to all the major industrial countries. As an example, Figure 5 plots the inflation rates of Germany and Italy, with the U.S. added as a basis for comparison. The Italian inflation rate follows much the same pattern as did the U.K. inflation rate compared to that of the United States. The German inflation rate, on the other hand, varies much less than the U.S. inflation rate although the two inflation rates share similar peaks in the mid-1970s and early 1980s as well as in the early 1990s.

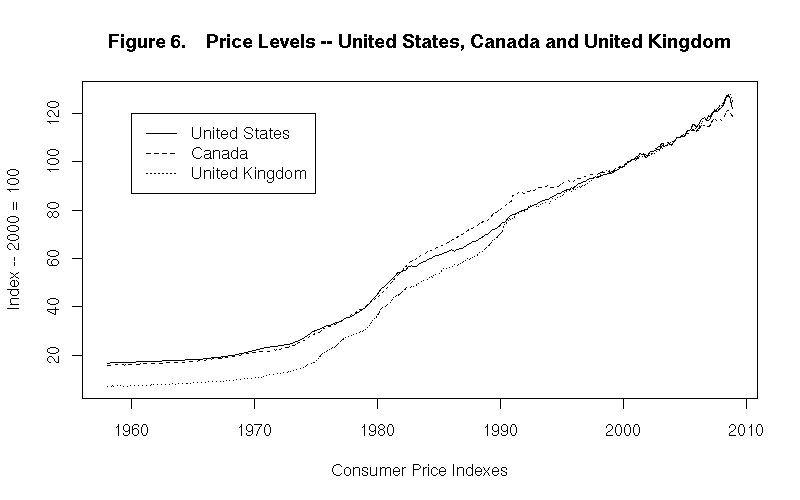

The differences in average inflation rates across countries are evident from a plot of their respective price levels. Figure 6 gives the consumer price indexes for the U.S., Canada and Britain. Great Britain's price level increased about fifteen-fold between 1958 and 2008, while the U.S. and Canadian price levels increased around eight-fold.

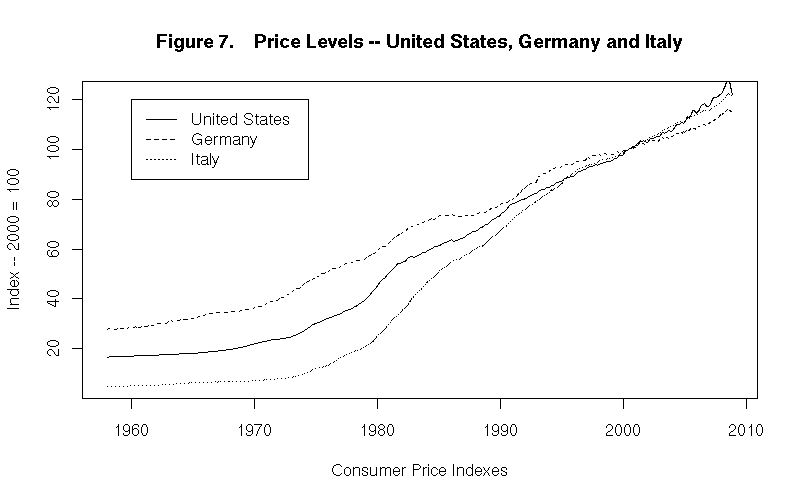

The consumer price indexes of the United States, Germany and Italy are plotted in Figure 7. As is consistent with the differences in inflation rates, the Italian price level increased just under twenty-fold between 1958 and 2008, while the German price level increased somewhat more than three-fold.

Before we end this lesson we should clearly establish the relationship between the inflation rate and the rates of growth of the prices of the individual goods in the economy. The inflation rate is the average percentage rate of increase of prices. The percentage rates of increase of the prices of the individual commodities are weighted by their shares, in the base period, in the value of the bundle of goods for which the inflation rate is being calculated. In any given year, some prices may rise and some may fall. The rate of inflation is positive only if, on average, the price increases (multiplied by their weights) exceed the price decreases (multiplied by their weights).

It is time for another test. Construct your own answers before looking at those provided.

Question 1

Question 2

Question 3

Choose Another Topic in the Lesson