Consider the equation of flow or goods market equilibrium developed

previously:

1. Y

= ( a + δ

+ ΦBT + DSB)/(s + m)

− μ/(s + m) r*

+ m*/(s + m) Y*

− σ/(s + m) Q

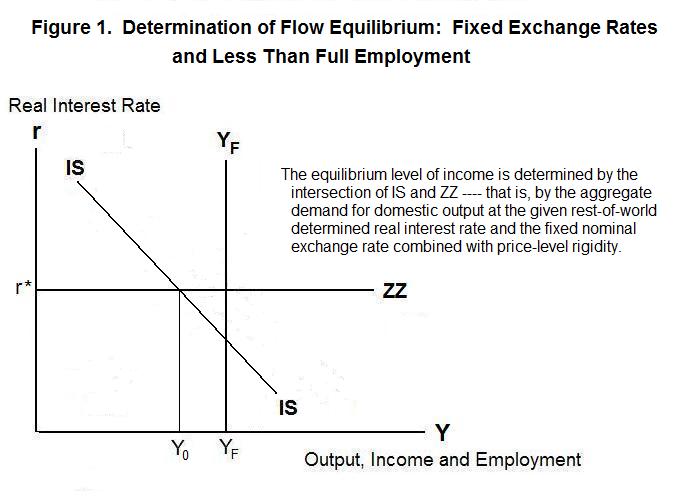

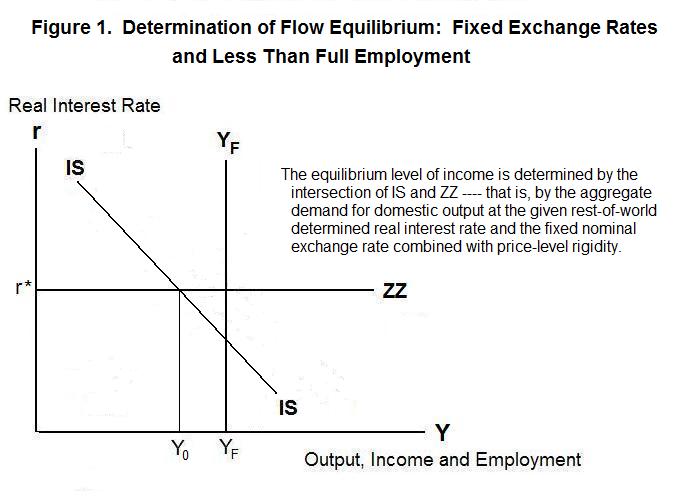

This equation appears as the downward sloping IS line in Figure 1.

We are now ready to analyze the process by which the

small open economy gets into equilibrium under conditions where

the government maintains the exchange rate fixed. By fixing

the exchange rate the government loses its

control over the stock of money. Monetary policy becomes

impotent. The domestic price level becomes independent of the

government's monetary actions, as do the levels of employment,

output and income if the price level is fixed.

The vertical line YF specifies the full-employment level of output and the horizontal line ZZ specifies the real interest rate determined by conditions in the world market. The IS curve gives the combinations of income and the real interest rate for which the aggregate quantity of domestic output that world residents wish to purchase equals the quantity produced. An increase in the real interest rate causes a reduction in desired domestic investment leading to an upward movement along the curve and a decline in real income. A rise in the real exchange rate shifts domestic and foreign demand off domestic goods causing the desired current account balance to deteriorate and the IS curve to shift to the left---a smaller level of domestic income is now associated with each level of the real interest rate. An exogenous increase in desired consumption or investment, increase in desired exports, or reduction in desired imports shifts IS to the right.

Suppose now that the government fixes the nominal exchange rate at the level Π0. If there is less-than-full-employment and P is thereby stuck at P0, there will be only one level of Y consistent with goods market equilibrium---that level appears on the left-hand side of Equation 1. We substitute the definition of the real exchange rate Q = P / (Π P*) into that equation and rename it as Equation 1a.

1a. Y = ( a + δ + ΦBT + DSB)/(s + m) − μ/(s + m) r* + m*/(s + m) Y*

Everything on the right-hand side is predetermined, so the equation gives us the equilibrium level of Y without mention of asset equilibrium. This equilibrium level of Y is shown as Y0 in Figure 1. Equilibrium is determined by the intersection of the IS curve and the ZZ line.

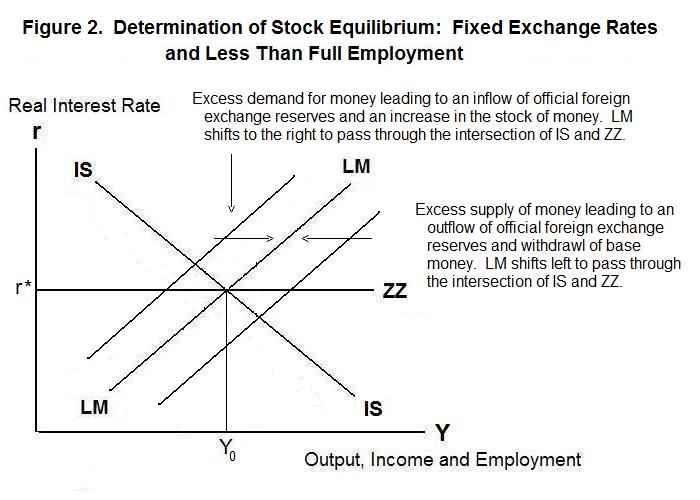

For asset equilibrium to hold, the LM curve must cross the ZZ line at the same place that the IS curve crosses it. What brings this about? Consider the asset equilibrium equation that was developed in previous topics:

2. M/P = − θ ( r* + τ ) + γ + ε Y

Given the world-determined real interest rate and the levels of income determined by flow equilibrium above, together with the fact that the price level is fixed, there is only one variable that can adjust to preserve asset equilibrium---the stock of money M. Asset equilibrium can only occur when domestic residents are holding their desired stock of nominal money balances. Suppose that they have more money than they want to hold as indicated in Figure 2 by the LM curve that crosses ZZ to the right of IS. Domestic residents will reestablish portfolio equilibrium by purchasing assets from foreign residents. This will create an excess supply of domestic currency and demand for foreign currency on the foreign exchange market. In order to maintain the fixed exchange rate, the authorities must sell official foreign exchange reserves in return for domestic currency. Domestic base money will thus be withdrawn from circulation and the money supply will fall, shifting LM to the left until it passes through the IS-ZZ intersection.

Suppose that LM crosses ZZ to the left of IS in Figure 2. The public's money holdings will now be less than desired and domestic residents will sell assets abroad to replenish them. There will be an excess demand for domestic currency and supply of foreign currency on the foreign exchange market and the government will have to increase its official holdings of foreign exchange reserves to prevent the domestic currency from appreciating. This puts high powered money in circulation, raising the money supply and shifting LM to the right until it passes through the IS-ZZ intersection.

The nature and implications of the asset adjustments under fixed exchange rates can be seen in more detail by looking again at the asset equilibrium Equation 2. Multiply both sides of the above equation by P to produce

2a. M = P [ γ − θ ( r* + τ) + ε Y ]

Using the results from the previous topic, the nominal stock of money can be expressed as a multiple mm of the stock of high-powered money and the latter expressed as the sum of its domestic and foreign source components. That is

3. M = mm H = mm [R + Dsc]

where R is the stock of official foreign exchange reserves and Dsc is the domestic source component.

The asset equilibrium equation 2a then becomes

2b. H = R + Dsc = (P / mm) [ γ − θ ( r* + τ) + ε Y ]

which can be combined with Equation 3 to yield

4. R = (1 / mm) P [ γ − θ ( r* + τ) + ε Y ] − Dsc

The condition of asset equilibrium determines the stock of foreign exchange reserves. Any change in the public's demand for nominal money balances given by the expression in the square brackets [...] in Equation 4 will result, in the absence of changes in the domestic source component, in an equilibrating change in the stock of official reserves.

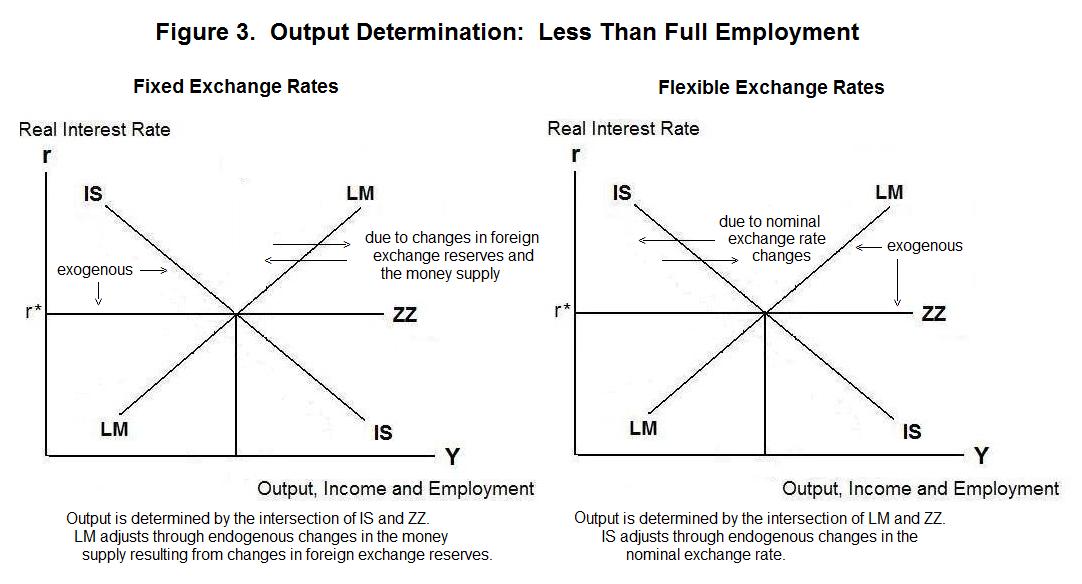

Any open market purchases or sales of bonds by the domestic central bank---that is, any change in Dsc ---will result in an equal and opposite change in the stock of official reserves R . The government has a choice. It can supply the public with its desired money holdings either by purchasing the appropriate quantity of domestic bonds or by adding to the stock of foreign exchange reserves. It has no control over the money supply. Monetary policy is impotent under fixed exchange rates. Any time the authorities try to shift the LM curve to the right by purchasing domestic securities they are forced to shift it back by selling foreign exchange reserves.

This contrasts with the situation under flexible exchange rates, shown in the right panel of Figure 3, where equilibrium is determined by the intersection of the LM curve and the ZZ line---by asset or stock equilibrium at the world real interest rate. The nominal exchange rate then adjusts to ensure that the IS curve passes through this LM-ZZ intersection. Monetary policy is effective in controlling output and employment under flexible exchange rates. It can have no effect on these variables under fixed exchange rates.

It is time for a test. Always figure out your own answers to the questions before looking at the ones provided.

Choose Another Topic in the Lesson