1. Q

= ( a + δ

+ ΦBT + DSB)/σ

− (μ/σ) r*

+ (m*/σ) Y*

− [(s + m)/σ] YF

there is only one level of Q consistent with flow

equilibrium. When the nominal exchange rate is fixed this

equilibrium level of Q implies an equilibrium level

of P , given the price level in the rest of the world

determined by conditions abroad. This can be seen from the

definition of the real exchange rate

2. Q

= P / (Π P*) =====>

P = Q Π P*.

We now turn to an analysis of the process by which

equilibrium is achieved when the exchange rate is fixed and the

economy is operating continually at full employment. In this

case, output and income are fixed at their full-employment levels

and the domestic price level is determined by the conditions of

commodity market equilibrium at the fixed world interest rate,

independently of domestic monetary conditions. As in the

less-than-full-employment case the government, by fixing the exchange

rate, loses its control over the stock of money. Monetary

policy becomes ineffective in controlling the domestic price

level. As can be seen from the condition of real goods market

or flow equilibrium

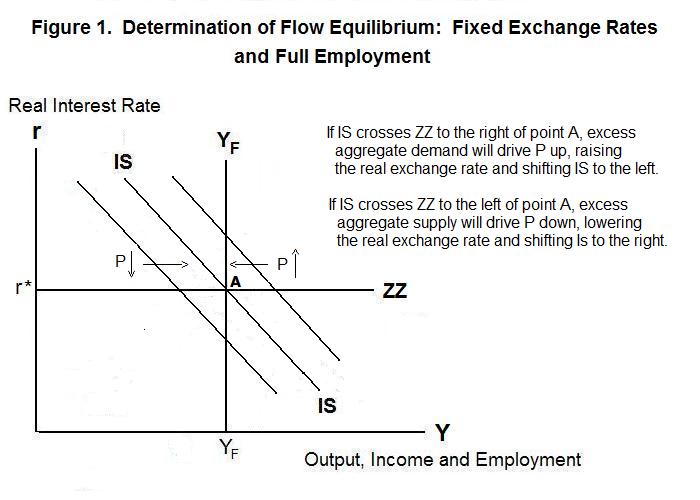

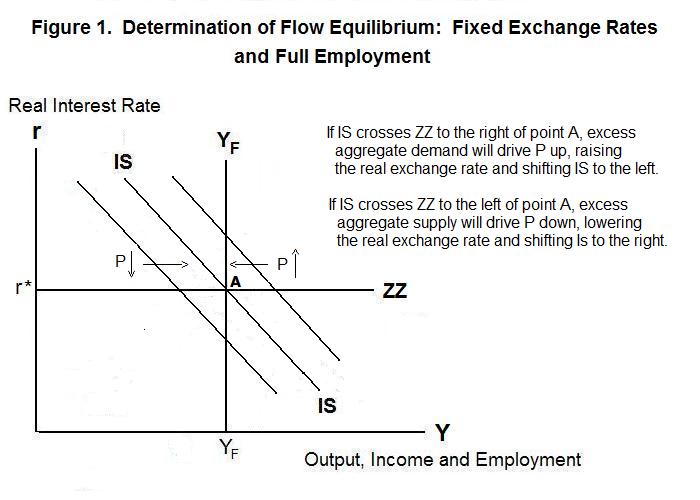

The price level, and thereby the real exchange rate, must adjust to ensure that the IS curve in Figure 1 crosses the ZZ line at the full-employment level of output given by the vertical line YF. By substituting the definition of the real exchange rate into Equation 1 we obtain the equilibrium value of P

3. P = [( a + δ + ΦBT + DSB)/σ − (μ/σ) r* + (m*/σ) Y* − ((s + m)/σ) YF] Π P*

The determination of P, illustrated in Figure 1, does not depend on the conditions of asset equilibrium. When IS crosses ZZ to the right of YF there is excess demand for domestic productive resources---wages and prices must rise. This raises the real exchange rate and shifts IS to the left. When IS crosses ZZ to the left of YF there is excess aggregate supply and wages and prices must fall, shifting IS to the right.

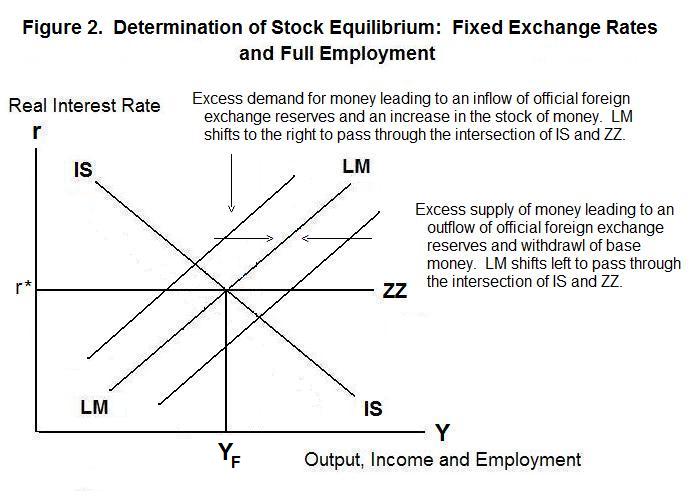

For asset equilibrium to hold, the LM curve must cross the ZZ line at the same place that the IS curve crosses it. The condition of asset equilibrium under full-employment conditions is

4. M/P = − θ ( r* + τ ) + γ + ε YF

Given the full-employment level of income, the real interest rate determined by world market conditions and the price level determined by flow equilibrium above, this equation determines the equilibrium stock of of money M .

When domestic residents have more money than they want to hold they reestablish portfolio equilibrium by purchasing assets from foreign residents. This creates an excess supply of domestic currency and demand for foreign currency on the foreign exchange market. To maintain the fixed exchange rate, the government must sell official foreign exchange reserves in return for domestic currency, withdrawing domestic base money from circulation. When the public's money holdings are less than desired domestic residents will sell assets abroad to acquire money, creating an excess demand for domestic currency and supply of foreign currency on the foreign exchange market. The government will have to increase its official holdings of foreign exchange reserves to keep the domestic currency from appreciating, thereby putting additional domestic base money into circulation.

These adjustments will ensure that the LM curve in Figure 2 crosses through the intersection of IS, ZZ and the vertical YF line. Indeed, the adjustment process is the same whether or not there is price level flexibility and full employment. The only difference is that under full-employment conditions the IS (and LM) curves must cross ZZ at YF.

As in the previous topic, we can express the nominal stock of money as a multiple mm of the stock of high-powered money and then express the latter as the sum of its domestic and foreign source components.

5. M = mm H = mm [R + Dsc]

where R is the stock of official foreign exchange reserves, the foreign source component of the money supply, and Dsc is the domestic source component, portion of the stock of base money created by central bank purchases of domestic assets. The asset equilibrium equation then becomes

6. R = (1 / mm) P [ γ − θ ( r* + τ) + ε YF ] − Dsc

A change in the public's demand for nominal money holdings (given by the expression in the square brackets [...]) will, at a constant domestic source component, lead to an equilibrating change in the stock of official reserves. And a rise (fall) in Dsc will require an equal fall (rise) in R .

Any attempt by the government to manipulate the money supply by open market operations in domestic bonds will lead to an equal and opposite change in the stock of official reserves. If the government does not supply the equilibrium quantity of money by open market operations in domestic securities it will end up doing so by adjusting its holdings of foreign exchange reserves. The government, by fixing the exchange rate, is tying the domestic price level to the price level abroad times the full-employment real exchange rate and thereby giving up the option of determining that price level by manipulating the domestic supply of money.

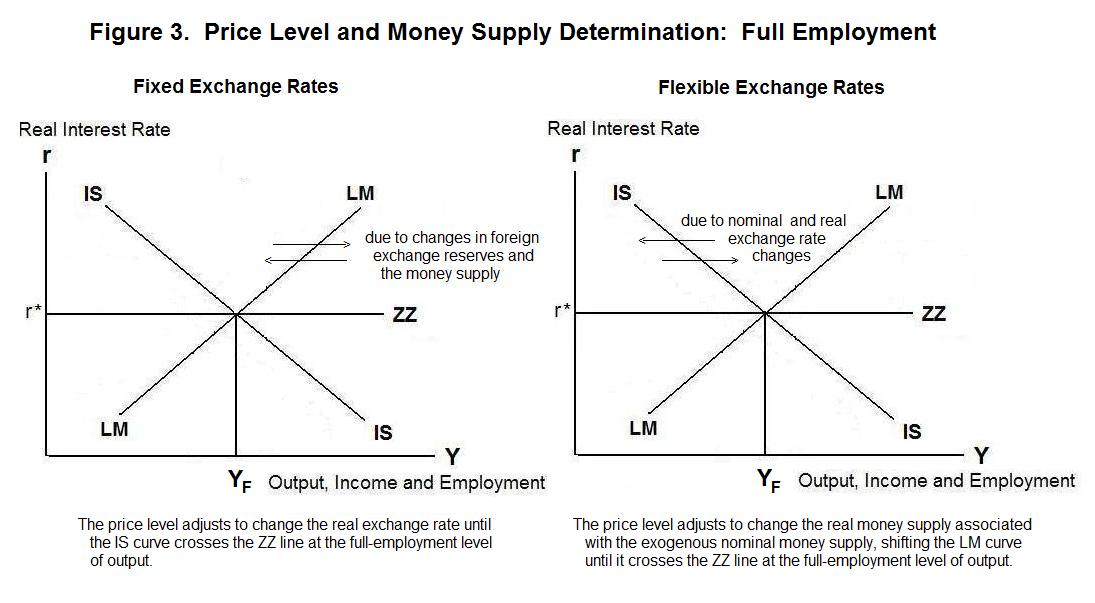

The fundamental result is worth repeating: Under fixed exchange rates equilibrium of the small open economy is determined by the intersection of the IS curve and the ZZ line---by goods market or flow equilibrium at the world real interest rate. The LM curve then adjusts through changes in the nominal money supply induced by changes in the stock of foreign exchange reserves until it passes through the IS-ZZ intersection. This is shown in the left panel of Figure 3. Under conditions where wages and prices are flexible the price level will adjust to ensure that the IS curve passes through ZZ at the full employment income level YF and the authorities will automatically adjust the money supply by changing the stock of official foreign exchange reserves, until the LM curve passes through that same IS-ZZ-YF intersection.

This contrasts with the situation under flexible exchange rates, shown in the right panel of Figure 3, where equilibrium is determined by the intersection of the LM curve and the ZZ line---by asset or stock equilibrium at the world real interest rate. The nominal exchange rate then adjusts to ensure that the IS curve passes through this LM-ZZ intersection. When wages and prices are flexible the price level will adjust, given the money supply, to ensure that the LM curve passes through ZZ at the full-employment income level YF. The nominal and real exchange rates will adjust automatcially to ensure that IS also crosses ZZ at that full-employment level of income. Monetary policy is effective in controlling employment and the price level under flexible exchange rates. It can have no effect on these variables under fixed exchange rates.

It is time for a test. Be sure to figure out your own answers to the questions before looking at the ones provided.

Choose Another Topic in the Lesson