Consumption externalities have already been discussed.

They arise when individuals feel worse off, or better off,

due to the fact that other individuals are consuming some good.

The gross social benefit is therefore the area under the

demand curve for the good up to the quantity consumed minus

the external cost, or plus the external benefit, of this consumption

to other non-consumers of the good. Consumption externalities are

difficult to quantify because they exist only

in peoples' minds. We now turn to another type of

externalities---production externalities---which are more

easily quantified.

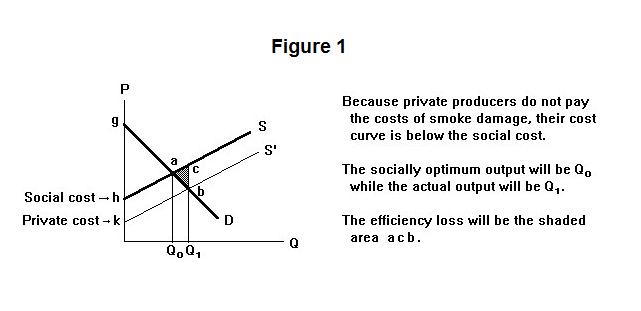

The classic example of a production externality is

smoke from industrial chimneys. The situation is portrayed in

Figure 1. Factories producing a useful commodity produce smoke

as an unavoidable by-product. This fouls the environment and

leads to additional medical costs and lower life expectancy of

people living in the surrounding area. If we take into account

these environmental costs, the cost curve of the industry is the

thick line h S. Since these environmental costs are

external to the industry in the sense that the firms in the industry

do not have to pay them, they do not enter into the calculation of the

industry's costs of production. The supply curve k S'

is the curve giving the private costs of production---that is, those borne

by producers.

The demand curve for the commodity, which as previously noted gives the marginal social benefit from the good, is the line g D. Because producers are operating on the private supply curve which, since it reflects only the privately borne costs and not the entire social costs, lies below the social cost curve, they will produce more output than is socially efficient---that is, output Q1 instead of the socially efficient output Q0.

The marginal cost of producing the last unit of output at output Q1 is given by the distance from point c to the horizontal axis while the marginal social benefit from that last unit is given by the distance from point b to the horizontal axis. It would therefore be socially efficient not to produce that last unit of output.

The same can be said for the second last unit of output, as well as the third last unit, etc., until the output level becomes Q0. The efficiency loss from not taking into consideration those social costs that were external to the industry is the sum of the vertical distance between the social cost curve and the demand curve for all units between Q0 and Q1. This is the shaded area a c b.

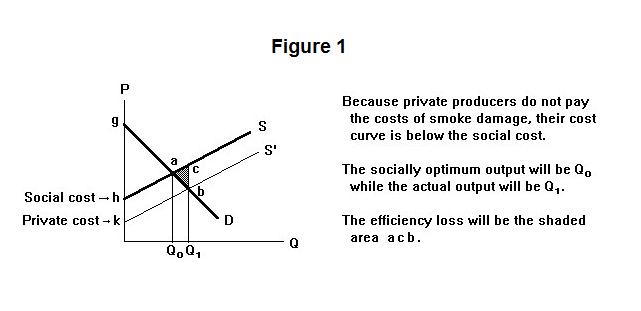

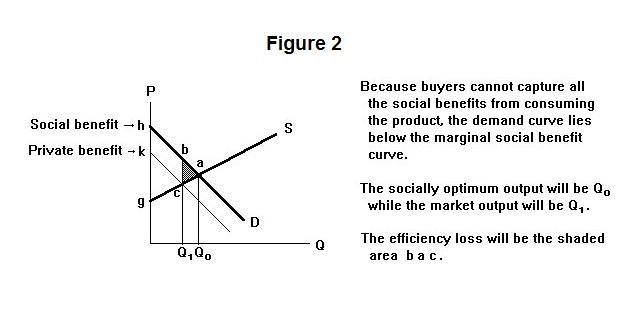

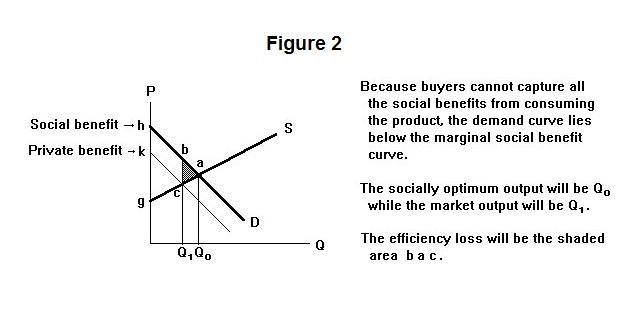

Externalities can also take the form of a divergence between the private and social benefits from consuming a good. The classic example is police protection. Suppose that there is no government operated police force and a person therefore hires a private police force to protect her property and, in the course of doing their work, those police arrest and jail some criminals. Since these criminals are no longer able to commit crimes, the property of others who did not hire the police force also receives protection. One therefore obtains benefits from hiring police protection that are less than the true social benefits. An externality on the demand side is illustrated in Figure 2.

The social marginal cost and benefit curves drawn as thick lines and the private marginal benefit is given by the thin line. The private and social cost curves are identical, but the private demand curve is below the social demand curve by the amount of the external benefit. Private demanders will thus purchase the quantity Q1 when the socially efficient quantity is Q0. A portion of the potential rents to consumers and producers from having the product, given by the area b a c, is lost.

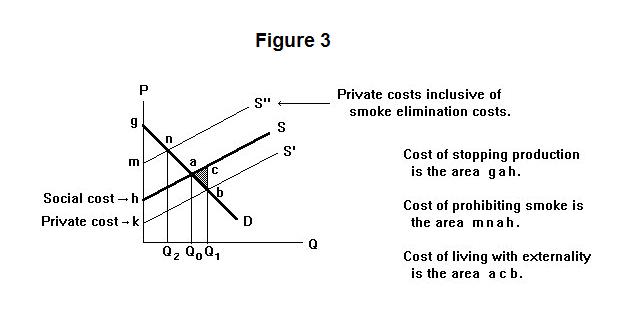

Now what should society do about these externalities? It is now fashionable to argue that all activities that cause harm to the environment should be stopped. Clearly, this argument makes no sense. Consider Figure 3, which examines again the problem of industrial smoke emissions.

One way for industry to cope with a prohibition on industrial smoke would be to reduce production to zero. This would cost society the area g a h rather than the smaller area a c b. Another possibility would be to install devices that filter out all the smoke. This would increase the cost of every level of output, shifting the private supply curve upward. As long as this new supply curve is below the social cost curve h S , there will be a net gain from the prohibition policy. In fact the curve h S will have in this case overestimated the social cost by not taking into account the possibility of using these devices. Account should have been taken of the fact that the the social, though not the private, costs of eliminating the smoke are less than the environmental damage produced by it. Once firms' private costs are brought into line with the social costs, in this case by prohibiting smoke by-products, the socially efficient output will be automatically result.

The problem is that the cost of filtering out the smoke may be so high that the cost curve of the industry inclusive of these costs may be, say, m S''. Output will fall to Q2. and the net benefit to society from having the product will decline to equal the area above m S'' and under the demand curve. This result would clearly be more inefficient than the option of simply living with (or dying from) the smoke. A better policy in this case would be to levy a tax on the good produced by this industry sufficient to shift the private tax-inclusive cost curve k S' up until it lies top of the curve h S. It would then become in the interests of private industry to produce the socially optimum output Q0.

Actually, a policy of simply levying a tax at each point in time on firms that pollute the environment equal to the damage they are doing to the environment at that point in time will in most cases be the most efficient way to handle the problem. The firms in question will choose to reduce output, install devices to filter out industrial smoke, or do what ever else happens to be the most cost effective. In this way the government is using the desire of firms to maximize their profits as a manipulatory device. The problem with this policy is that it is often difficult to calculate the environmental damage that firms are doing and measure how that damage changes as firms' behavior changes.

Externalities on the benefit side can also be eliminated by appropriate tax policies, to the extent that such policies can be designed. In the example illustrated in Figure 2, reproduced here for convenience, this can be accomplished by imposing a subsidy (negative tax) on output sufficient to increase it to Q0. Such a subsidy, paid to suppliers, would shift the cost of the industry down to u S'. Under the assumption that all the supply and demand curves are linear, the subsidy would be b c .

In the case of external benefits arising from private police forces, governments do not handle the problem by giving subsidies to private policing activity. Though private security police are common, most policing is typically handled by police forces created by and answerable to the government. These police represent the law-enforcement power of the state---they are the vehicle by which the members of society collectively enforce the rules they chose to place on themselves through the law-making process. In fact, a public police force is necessary to enforce appropriate rules of behavior of private police who are paid to act strictly in the interests of the people that hire them. In most properly policed jurisdictions, private police forces are relegated to areas in which no externalities occur. Private police (usually called security guards) typically protect only the property of the party that pays them---their function is to call the public authorities in the event of trouble. Where external benefits of private policing occur, law enforcement matters are (or should be) handled by the public police force.

It is time again for a test. Be sure to think up your own answers before looking at the ones provided.

Question 1

Question 2

Question 3

Choose Another Topic in the Lesson.