The fundamental feature of contract theories is that firms

and workers make an implicit contract by which the firm will guarantee its

employees, once they have obtained sufficient seniority, continuous

employment at a real wage rate that is invariant to changes in market

conditions. In return, the employees agree to work for wages that

are lower than they would require if stability of employment and

wages were not guaranteed. As a consequence of such contracts,

firms lay off junior workers in recessions and hire them back in

booms. Our first concern is to understand why workers and firms would

make such contracts and how those contracts are enforced.

Most workers have large fractions of their wealth invested

in their human skills---if the market for those skills goes bad

their income will decline drastically. Workers will pay a price

in terms of wages to achieve income stability. The owners of

firms, on the other hand, have ample opportunity to diversify

their wealth-holdings across a wide portfolio of assets. They

can thus acquire somewhat reasonable security of income by sharing

ownership in a number of firms and holding part of their wealth

in bonds and fixed-income assets. Unforeseen losses on some assets

will thus tend to be offset by unforeseen gains on others.

Given that workers cannot diversify their wealth-portfolios

as well as can the owners of firms, it is in their interest to

make deals with their employers. The owners of firms can gain

by absorbing increased variability of profits, which they can

diversify away by holding a wide variety of assets, in return

for maintaining stable levels of employment at steady but suffiently

lower wages to achieve higher long-run average profit levels. And

workers thereby achieve security by accepting lower wages.

The security workers buy in this way will frequently extend

well beyond the mere stabilization of wages across booms and

recessions, encompassing pension plans, paid sick leave, medical

insurance, and so forth. Indeed, even when there are no labour unions

firms typically take pains to ensure that no one is fired without good

reason and that promotions are based on performance, not friendships.

They do this in part to minimize risk for their employees and thereby be

able to hire workers at wages that are lower in compensation for

the greater financial security they provide. It is thus possible

for workers to purchase, in return for accepting lower wages,

insurance against unforeseen events and arbitrary behaviour of their

employers that could not otherwise be purchased in the market.

But how are these contracts enforced? Contractual details

are difficult to write down because many aspects of the relations

between employers and employees depend on common sense and good

judgment and cannot be measured on a quantitative scale. What is

to stop an employer from paying low wages in the understanding

that job security will be provided, and then dumping a worker on

some pretext when conditions change and there is immediate gain

from abrogating the contract? The main reason a firm would not

behave in this way is that word would get around among current

and prospective employees and the firm would no longer be able

to hire good workers at low wages. The contract is an implicit

one, enforced not by courts of law but by the needs of firms to

maintain their reputations. For this reason such contracts are

often called quasi-contracts.

We can now analyze the implications of these contracts for

employment levels over the business cycle. The contracts are

designed to protect workers against a wide variety of unforseen

shocks, not just cyclical changes in demand. They protect against

obsolescence of skills, in which case the employer would pay for

retraining or shift the worker to a job that he/she could handle,

without reduction in salary. But they do not protect workers

against their own incompetence if clearly established. Also, when

the survival of the firm is in jeopardy an alteration in the terms

of the contract will be widely perceived as justified---the reputation

of a failed firm is worthless in any event.

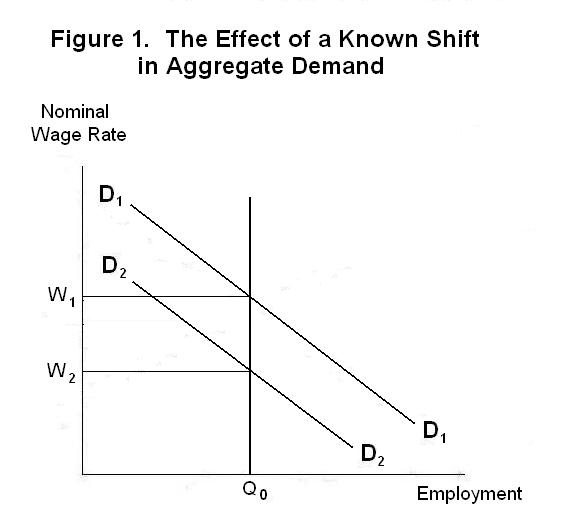

These implicit contracts are, of course, based on real, not

nominal, wages. So if everyone knows that there is a downward

shock to aggregate demand which lowers equilibrium nominal wages

and prices by 10 percent, nominal wages will be immediately adjusted

downward by that amount with the agreement of all concerned. This

can be seen in Figure 1 which portrays the situation for a typical

firm. Due to a shift in aggregate demand in the economy as a whole

the firm's demand for labour shifts from D1D1

to D2D2. Nominal wages fall immediately

from W1 to W2 with employment

unchanged. It follows that nominal wages will be constantly adjusted by the

expected inflation rate in the economy as was the case in our

previous auction and search models.

While the previous theoretical sketches explain many common

features of cyclical unemployment they give us no understanding

of why firms lay workers off in recessions and refuse to hire

people willing to work at or below the wages currently being

paid. We now turn to the development of a contract theory that

will explain this phenomenon. Our theory will contain relevant

features of the several contract theories that have been devised

by economists in the past.

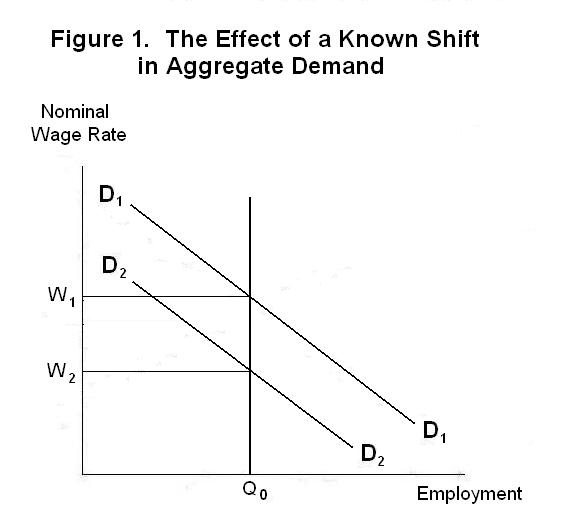

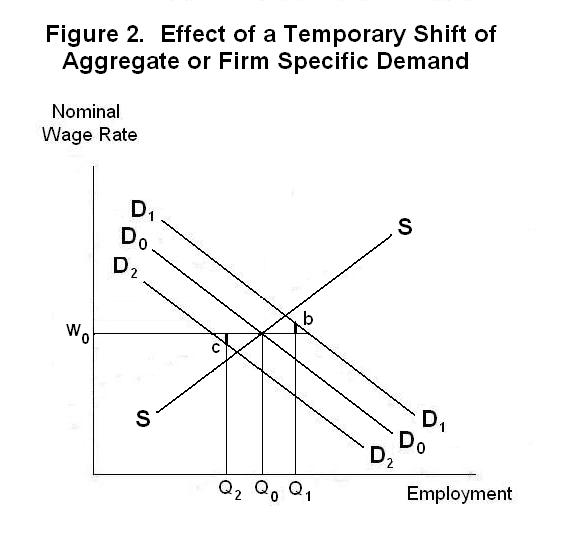

Suppose now that economy-wide changes in aggregate demand occur that are perceived either as temporary economy-wide changes or temporary firm-specific changes. Firms have contractual reasons not to make wage adjustments in response to these shifts. Analysis can proceed with reference to Figure 2. Suppose that demand shifts alternately between D1D1 and D2D2. The firm will hold wage rates constant at some average level W0 reflecting the average level of demand and vary employment between Q1 and Q2. Were the firm to vary wages, workers would vary employment offered along the supply curve SS. This supply curve is drawn with the understanding that all other firms in the industry, and the whole economy, would be making the same wage adjustments in response to the same shocks to their demand curves for labour.

Instead of varying wages, however, the firm adjusts employment by laying off and rehiring workers at a fixed wage rate reflecting its estimate of long-term market conditions. As a result the value marginal product of labour, measured by the distance between the demand curve and the horizontal axis, is below the wage rate in periods of slack demand and above it in periods of excessive demand, as shown by the thick line-segments at points c and b . A crucial part of the argument is that workers are indexed along the horizontal axis by seniority, starting with the most senior worker at the origin with increasingly less senior ones out along the axis to the right. As the firm varies employment between Q1 and Q2 less senior workers are layed off first and rehired last. This is in contrast to the movement along the SS curve where workers would vary their labour supply according to the aggregate of individual preferences.

The firm could increase its current-period profits by hiring less workers than Q2 in bad times and more workers than Q1 in good times. But this would in fact lower its long-run profits because it would then have to pay a wage rate above W0 to compensate its workers for the greater uncertainty of income and employment. In effect, the firm is making life-time contracts with its employees, guaranteeing them reasonable treatment along with increased income stability as seniority is acquired. It is in its interest to do so because the average level of wages it will have to pay will then be less.

The contract theory just developed explains why firms lay off workers in recessions. Even if everyone knows that the level of nominal aggregate demand is below normal, it pays for layoffs to occur instead of wage cuts to provide income stability for the more senior workers. And in periods when aggregate demand is temporarily high, it pays firms to maintain wage stability, rehiring workers that they had layed off in previous slack periods or hiring new workers who will accept the current wage in order to build up seniority. It should now be obvious that the contract theory explains why workers do not quit their jobs in recessions. Moves between jobs occur in boom periods when firms are hiring.

Under the auction and search theories, a crucial feature of unemployment rate fluctuations was missinformation about the state of aggregate demand. Under the contract theory, employment will fluctuate around its natural level even if the state of aggregate demand is always known. Of course, the unemployment rate will also fluctuate under the contract theory in response to unforseen shocks to aggregate demand.

When there is a permanent change in the equilibrium rate of inflation in the economy, the time path of nominal wages will respond immediately when the change is known and there are quasi-contracts between firms and workers because there is no incentive to delay the path of nominal adjustment. But with union contracts that are in writing there may be an incentive on the part of one or both parties to not renegotiate previously agreed-upon multi-year wage rate provisions. When workers and firms do not realize that fundamental changes in the inflation rate are occurring, there is a further reason for nominal wage adjustment to be delayed.

It is test time. Be sure to think up your own answers before looking at the ones provided.

Question 1

Question 2

Question 3

Choose Another Topic in the Lesson